Developing Better Initial Coin Offerings (ICOs): An Overview of DAICOs

- Post by: Muhammad Nauman Shahid

- June 15, 2021

- No Comment

Initial coin offers (ICOs) continue to spark heated disputes within the crypto industry. While token fundraising systems continue to grow in popularity, there are some pretty strong indications that they may be improved. Nobody should expect ICO models to be impenetrable in such a short period of time, and similar to Initial Public Offerings (IPOs), improvements should be welcomed as a sign of the model’s evolution.

While I feel that drawing comparisons between ICOs and IPOs is frequently incorrect, we can learn some lessons from the latter’s past. The first modern IPO occurred in 1602 when the Dutch East India Company raised funds by selling shares and bonds to the public. However, public offers did not become more prevalent in markets such as London until the 1800s, and several of the present practices, such as quiet periods or stag profits, were established very recently. If we acknowledge that initial coin offerings (ICOs) are a legitimate method for businesses to acquire capital, we should seek out new mechanisms that improve the current dynamics of token offerings.

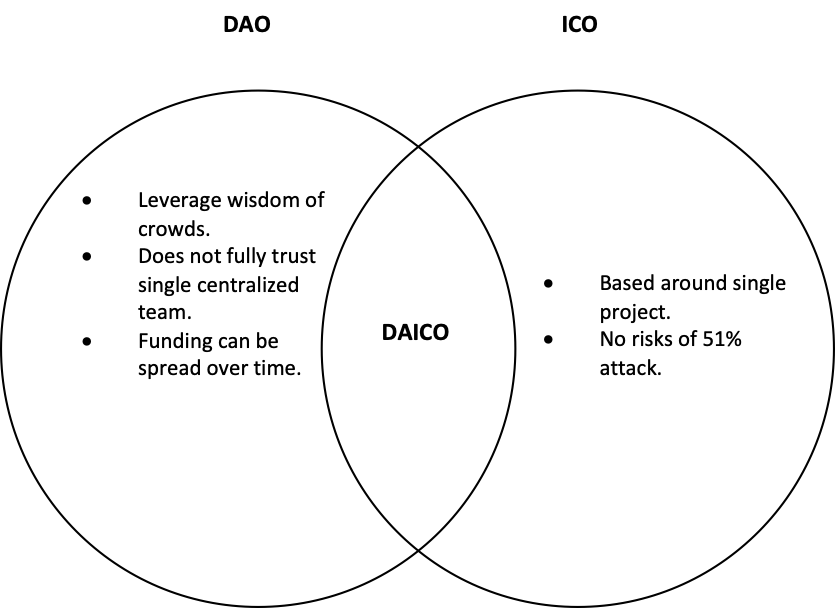

One of the most exciting recommendations to modify the current ICO model came from Ethereum developer Vitalik Buterin at the start of 2018. The concept, dubbed DAICO, aims to merge some of the best ideas behind ICOs with some of the controversial Decentralized Autonomous Organization (DAO) concepts. Vitalik has been constantly proposing ways to improve the procedures underlying ICOs in order to relieve some of the ethical and financial problems that now surround the fundraising procedures. DAICO appears to be one of the most intriguing ICO improvement concepts I’ve seen in the last three years.

What is DAICO?

The primary purpose of DAICO is to prohibit entrepreneurs from having total access to funds raised during an ICO, particularly if the token sale occurred prior to the product being developed. It’s no secret that many ICOs have been plagued by scams and bogus ideas that never progressed past the whitepaper stage. How does the DAICO model directly address this issue?

DAICO combines the decentralized voting processes of DAOs with the funding dynamics associated with ICOs. DAICOs, like ICOs, are based on smart contracts developed by businesses seeking to generate funding for specific projects. A DAICO contract begins in “contribution mode,” defining a method for anybody to donate Ethereum to the contract in exchange for tokens. Thus far, this appears to be a typical ICO. The primary distinction between DAICOs and ICOs occurs AFTER the initial token sale and involves a process that Buterin affectionately refers to as tap.

A tap essentially limits the amount of money that the development team may withdraw from the contract every second. As with DAOs, shareholders can vote on specific token-related resolutions. To be more precise, the DAICO model encompasses two distinct sorts of resolutions:

- Raising the tap.

- Permanently self-destructing the contract (or, more precisely, putting the contract into withdraw mode where all remaining Ethereum can be proportionately withdrawn by the token holders).

The DAICO contract implicitly provides certain benefits by prohibiting the firm from taking funds without the consent of token holders and by specifically avoiding certain bad scenarios that are common in ICOs. Maintaining a fair level of tap should ensure that the funds raised are utilised wisely. While a malicious actor may attempt to increase the level of the tap for his or her own gain, the DAICO models believe that in the long run, the wisdom of the shareholder community will prevail in maintaining a sufficient level of the tap.

Concerns About DAICOs

The concepts underlying DAICO are incredibly innovative, combining the best aspects of two of the most influential concepts in the history of cryptographic tokens. However, the model does not come without drawbacks. One of my primary concerns is that ignorant token holders can strangle companies by arbitrarily decreasing the tap level for the sake of conservatism. Additionally, I believe that the procedure for terminating the contract should be more controlled than a simple vote. After all, Apple shareholders cannot just vote to dissolve the firm.

Many of the techniques that might be applied to improve ICOs, in my opinion, can be extrapolated from how public firms work now. I’ll elaborate on a few of those themes in a subsequent post.